Onboarding Guide

Sign Up & Secure Your Account

To get started:

Visit the sign-up page, enter your name, email, and create a secure password.

Agree to the terms, submit the form, and confirm your email via the link sent to your inbox.

We also require Two-Factor Authentication (2FA) to protect your account.

How to Set Up 2FA:

You may follow the Following Procedures to set it up.

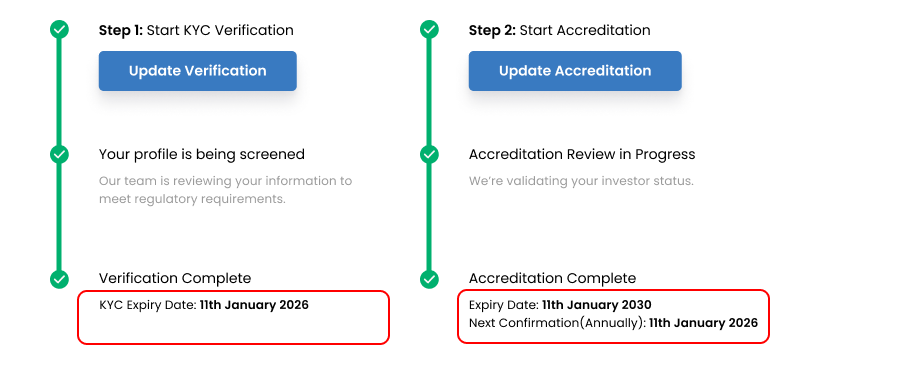

Verification and Eligibility

To access investment opportunities, you must complete identity and eligibility verification. This ensures compliance with regulations and helps protect all participants on the platform.

We partner with Parallel Markets, a trusted third-party provider, to handle identity (KYC), business (KYB), and accreditation verification. Their platform offers a secure and streamlined process that you can complete directly within our onboarding flow.

Depending on your investor profile, Verification and Eligibility may include one or more of the following:

KYC (Know Your Customer): Required for all individual investors.

KYB (Know Your Business): If you're investing through a legal entity (such as a company or trust)

Accreditation Verification: Required in certain jurisdictions or for specific offerings. Investor Class Eligibility are platform-specific. For more information, Click Here.

Documentation and Requirements

For KYC (Individuals):

Government-issued ID (e.g., passport, ID , driver's license)

Proof of address (e.g., utility bill, bank statement)

Selfie or live facial check to confirm your identity matches the ID

For KYB (Businesses):

Certificate of Formation/Incorporation and Articles of Association (or equivalent)

List of beneficial owners (typically ≥25% ownership), each accompanied by completed KYC verification

Bank statement or proof of address for the entity (usually dated within the past 3 months)

For Accreditation (1 of the following):

Recent tax documents such as a 1040 tax return, W-2, 1099, or K-1.

Proof of assets (e.g., bank or brokerage statements, real estate appraisal) and liabilities (e.g., a recent credit report). Documents must be dated within the last 90 days.

CRD number if you hold a qualifying SEC-recognized license (e.g., Series 7, 65, or 82).

Note: Additional requirements may apply for entities or individuals subject to enhanced due diligence.

Post-Application

Once you've submitted your verification:

Most users are verified within minutes, but manual reviews may take 1–2 business days.

You’ll receive real-time updates via in-app notifications and email.

If any documents are missing or unclear, you’ll be prompted to resubmit or provide additional information.

To avoid delays, please respond promptly to any follow-up requests.

FAQs:

For more Information specific to Account and Security, Click Here.